Um, duh...

I just read a line from a Motley Fool RSS feed:

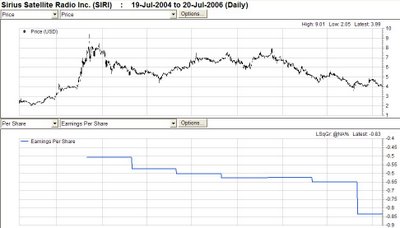

"Everywhere you look, you will find companies that have seen their shares plummet despite good news. ... Sirius Satellite Radio's (Nasdaq: SIRI) shares have been cut in half since peaking two years ago despite blowing past subscriber growth targets."

Um, yeah, but they continue to lose more and more money as they grow subscibers. Adding subscribers doesn't mean value's been added and the stock should go up. Lest we not forget Krispy Kreme Donuts which suddenly sprouted stores everywhere?

SIRI EPS:

source: Factset Research Systems

What's worse, SIRI is not even profitable at the Gross Margin level. Ugh. I'll give TMFBreakerRick the benefit of the doubt - because I'm sure I've written some silly things before too.

5 Comments:

Margins are a little less important when you have high fixed cost and low variable costs. Growth is by far the major factor along with content spending i.e. Stern.

Well said mattkelly54.

Another way of puting it is that there are a variety of strategies. Some even call for losing money just to gain market share and once reaching economy of scale to switch to profit mode.

Others call for a premptive strike against competitors thus leaving the 'attacker' in a market dominating position. As soon as the money losing strategy is completed the company uses its new position of strength to charge as much as the customers will stomach...then you see profits.

In spite of the general knowledge stated above, we are not serious about Sirius.

Last I checked, giving away your products wasn't a good way to make money in business - that is unless you are a drug dealer.

Sirius Sat. Radio isn't crack cocaine by any means. In the world of podcasting, traditional radio, XM, Netflix, MP3 players, DVD players in cars, etc...there are plenty of ways to keep ourselves entertained while on the go.

Regardless, the point was that despite a stock having "good news" that doesn't mean its price should go up. There is plenty of bad news - Sirius can't make a penny. Will they ever? Losing more and more money is not a good catalyst for stock price appreciation. Earnings tend to fuel stock prices.

My guess that crossprofit's not serious about Sirius is because profitability is in question.

And what "growth" are you referring to MK? Vonage is growing too. Should we buy that?

I agree. I'm not Serious about Sirius equity. But there may be real value in the CCC rated other portions of the cap structure. Even in default these have real value. I do not see the revenue stream evaporating, and if XM and SIRI pull a miracle merger, it is a huge positive for negotiations with Stern, Oprah, Snoop Dog, MLB, NFL and others

I was saying I think that Operating leverage is near 100% for SIRI so growth is a big factor. Funny you should mention Vonage. I was just beginning to think it may be a deal. Sentiment cannot be much worse. I do not know the business, but they are definately lower cost than cable VOIP which I have no clue why anyone would use for phone service.

I currently use Skype, which I am the only person in the world who thinks was a steal for EBAY. I see this being the phone killer. But as far as Vonage, as an analyst I would put some value on marketing which I am sure they are expensing. What is the monetization factor 0.85%? I do not know. But I would hope that a capitalist is running this firm. And I have done zero investigation, but I am willing to bet that their is real value there. I am wondering how much investigation you have done actually? Or do you get your analysis from Cramer? That being said I think Cramer is pretty solid.

Matt

Post a Comment

<< Home