Checkup: RVB Funds

Finally, Marketocracy has updated the fund rankings for the first half of 2006.

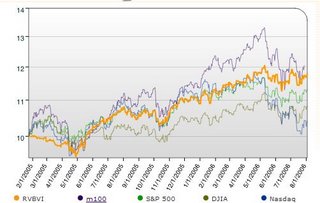

I'm pleased that the RVB Value and Income Fund (RVBVI) has earned me a green star for top quartile performance. In reality, it has performed better than that. Here are the stats:

RVBVI

Alpha: 4.38% (and this is the important one)

Beta: 0.80

R^2: 0.57

The RVB Smart Buys Long Fund (RVBXX) has a bit of a different story. I pressed too hard on the accelerator at the wrong time, and you can see that bet has not paid off recently - the fund has fallen rather sharply in value relative to the S&P 500. Rest assured, I am not content with this performance and continue to make changes to get where it needs to be. The addition of some of the inverse ETF's may help.

The RVB Smart Buys Long Fund (RVBXX) has a bit of a different story. I pressed too hard on the accelerator at the wrong time, and you can see that bet has not paid off recently - the fund has fallen rather sharply in value relative to the S&P 500. Rest assured, I am not content with this performance and continue to make changes to get where it needs to be. The addition of some of the inverse ETF's may help.RVBXX

Alpha: -5.62% (and this is the important one)

Beta: 1.86

R^2: 0.82

Meanwhile, the bearish fund experiment remains just that, hence no update there.

I will continue to work on idea generation and portfolio construction in the two main funds and continue to strive for #1.

0 Comments:

Post a Comment

<< Home