I have said this to many people, but

Blue Nile is an incredible business. One of Warren Buffett's big reasons for investing in a company is that he tries to envision where it will be in 5 years - and if the outlook is rosy, he's interested.

Blue Nile is the Borsheim's of my generation. Like Ebay and Amazon, Blue Nile isn't going anywhere anytime soon. My generation is comfortable buying items online, even if said items are as expensive as they are on Blue Nile. That has been an argument against the company in the past, but as time rolls on, I see this argument diminishing. The biggest problem I see with Blue Nile is that the company is

severly undermarketed. There are so many people out there who have never heard of it. Wall St. types typically know it, because it has been a great small cap/growth story. And that certainly is good for business - having Wall St. on its client list. But the general consumer has not heard of it, and that represents a two-fold problem. First, the obvious one is that Blue Nile isn't reaching potential customers. The second problem is that the door may still be ajar for someone else to clone the business model. Until more marketing efforts create an even stronger brand, this remains a bit of a risk.

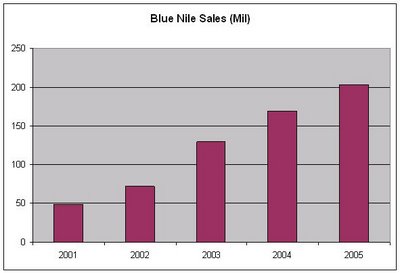

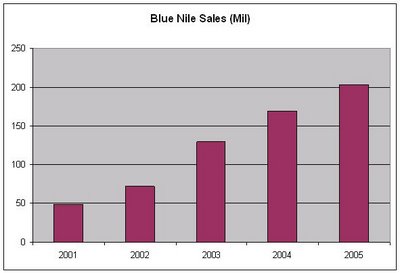

But the company is certainly off to a fantastic start in its first 6 years. It may be a little hard to grow at a rate that some other companies do - because it is in the jewelry business. But, going back to that 5 year question - Where do I see Blue Nile in 5 more years? Doing more business than it does today. And 5 years after that, it will do more business than it did during the previous 5. Probably alot more.

The stock trades at 45 times earnings, which certainly isn't cheap. But, in the e-tailing sector, stocks like Ebay and Amazon also trade at or above 40 times earnings. So on a relative basis, one could perhaps argue that the stock is roughly in-line with its peers. But, the stock certainly isn't "cheap" as Mr. Buffett would like. Nor has it existed for 10 years, as he would like. But if he were comfortable with internet stocks, I think he'd love Blue Nile.

I am intentionally not getting too analytical with this post, because of the analogy to Warren's investing style. The bottom line is that if you're an investor who would like to own a solid business for many years to come, Blue Nile is worth putting on a shopping list. If the market makes it a relative bargain, it's probably worth pushing some of your chips towards ticker NILE.