Is Pfizer (PFE) cheap again?

Now I'm talking about investing again. "Geez", you say, "how can I know what the hell that guy is talking about on what day?" Well, I may be bringing in some fundamentals for my investing speak, or some rational thoughts.

First off, Pfizer pays a 3% dividend. Now, I'm not a huge 'collect the dividend and get rich' kind of guy, but at least the dividend can offer a little bit of downside protection. The stock trades below 20 times earnings. I'm not a huge P/E, kind of guy, but that seems reasonable, as compared to Bristol-Myers Squibb, which has the same P/E.

The stock seems to have the cheapest price/book ratio (2.8) of the group -

SGP - 5.3

MRK - 3.5

BMY - 4.4

ABT - 4.6

Now, the Net Return on Assets is just over 10%, and the only company close to compare is ABT, at about 12.3%, and the rest are well below that.

From a rational standpoint, PFE has some great drugs in the pipeline, such as what they are doing to work on balancing the body's cholesterol - for heart health. Lipitor, already the world's best selling drug is also Pfizer's baby - so they have expertise in this area.

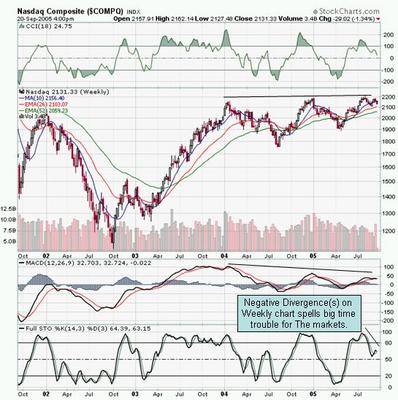

So, do we go buy the shares now? I'd say no, for now. I'd take a pass. Why? We can wait yet. Let's see how the market behaves, and let's see how PFE is acting in conjunction with the markets. At this price, it offers decent value. But, why pull the trigger now? Unless the markets look favorable, or UNTIL they do, rather, the least risky thing to do is stand aside.